Why Should You Care about CTV Advertising in 2024?

PUBLISH DATE: 16 December 2022

Learn why CTV advertising should be in the marketing mix of brands in 2024.

Introduction

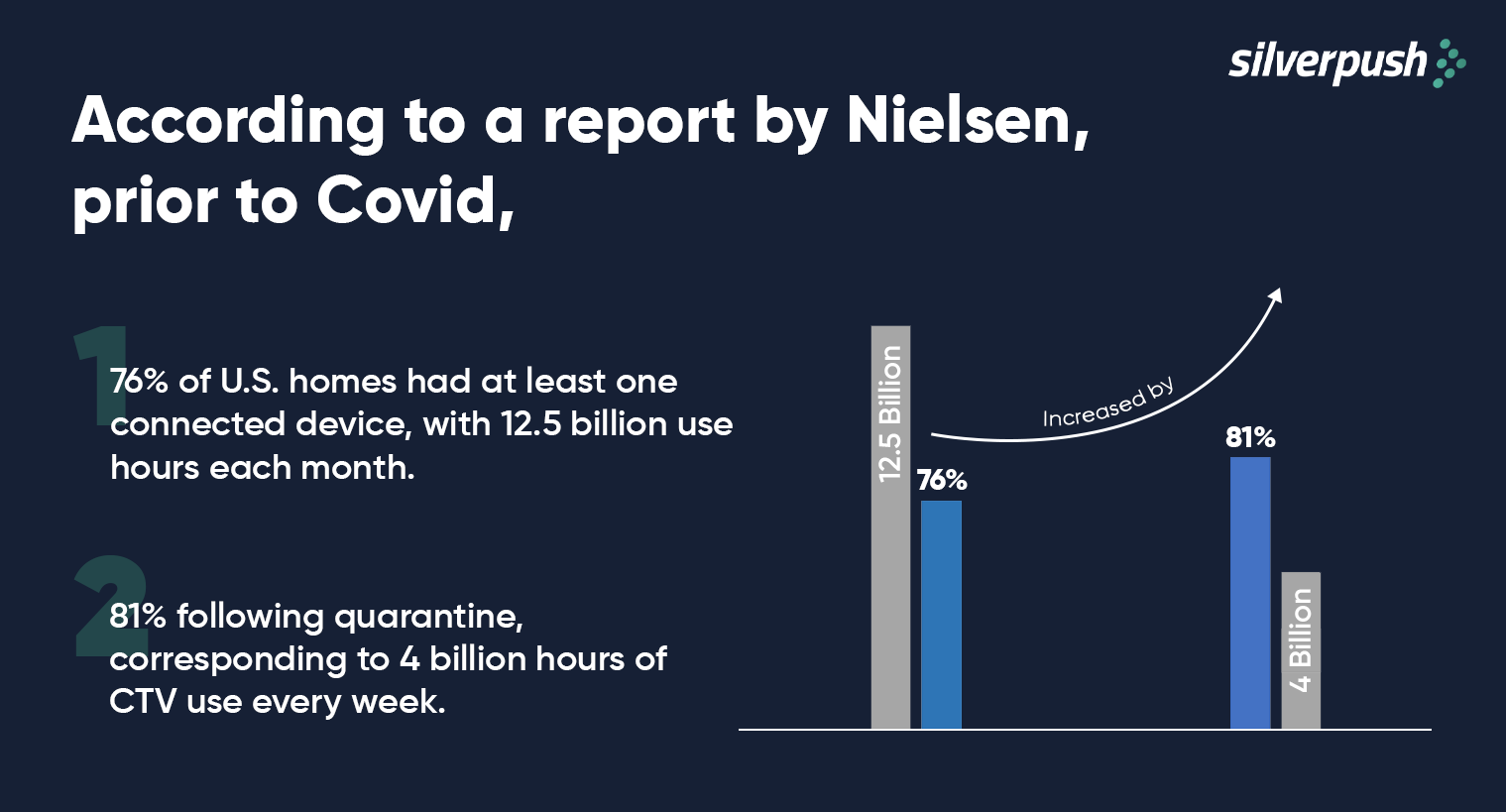

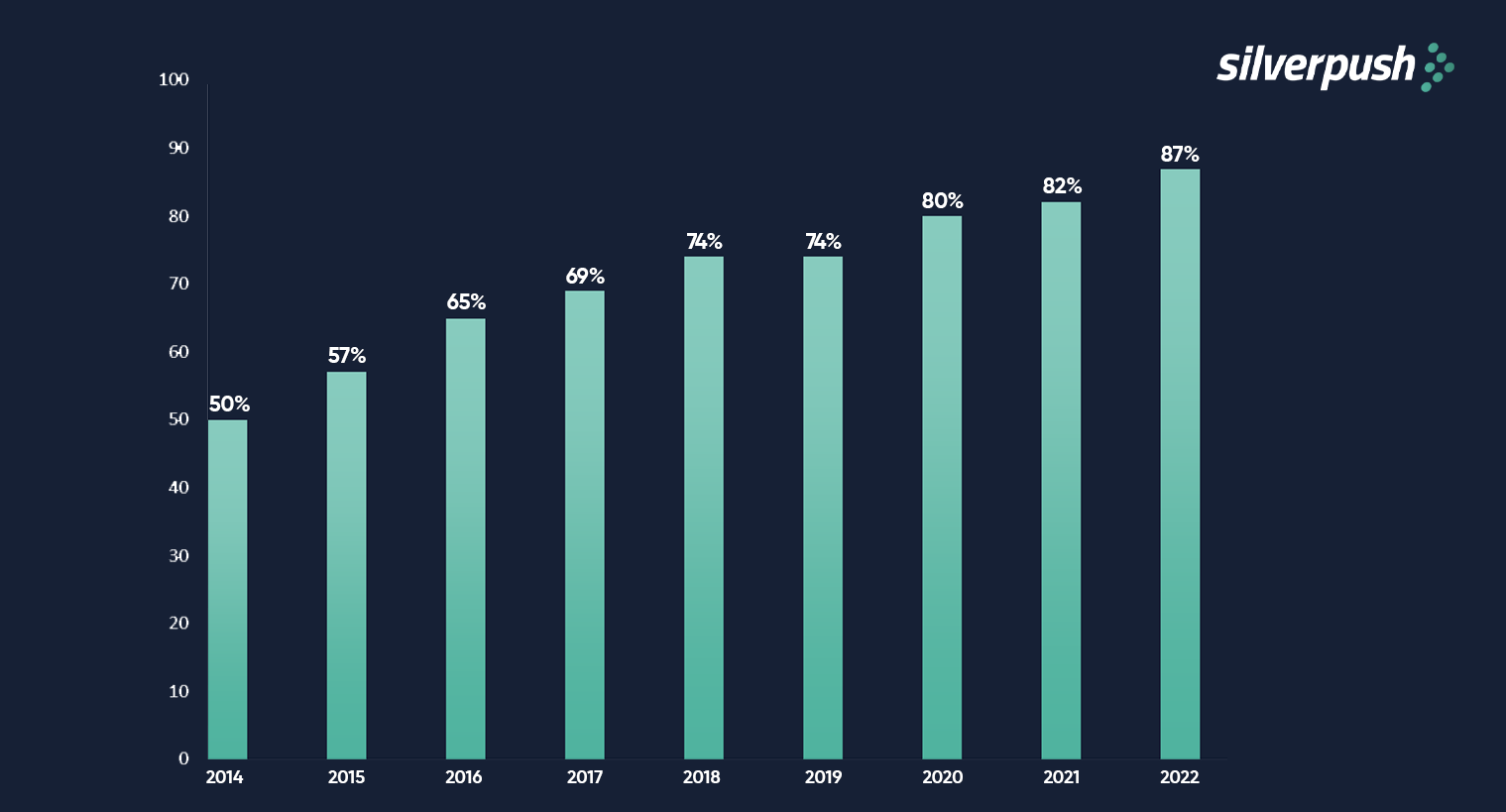

After several years in the dark, it’s finally time for connected TV (CTV) to enter the limelight. Connected TV is the darling of 2020. With much of the world under lockdown, the quantity of over-the-top (OTT) content consumed on CTV devices has skyrocketed, and this trend is only expected to continue.

86% of consumers are willing to see CTV ads that are relevant to them or entertaining, but 40% of the audiences are expected to reject CTV if there are too many ads. (MarTech)

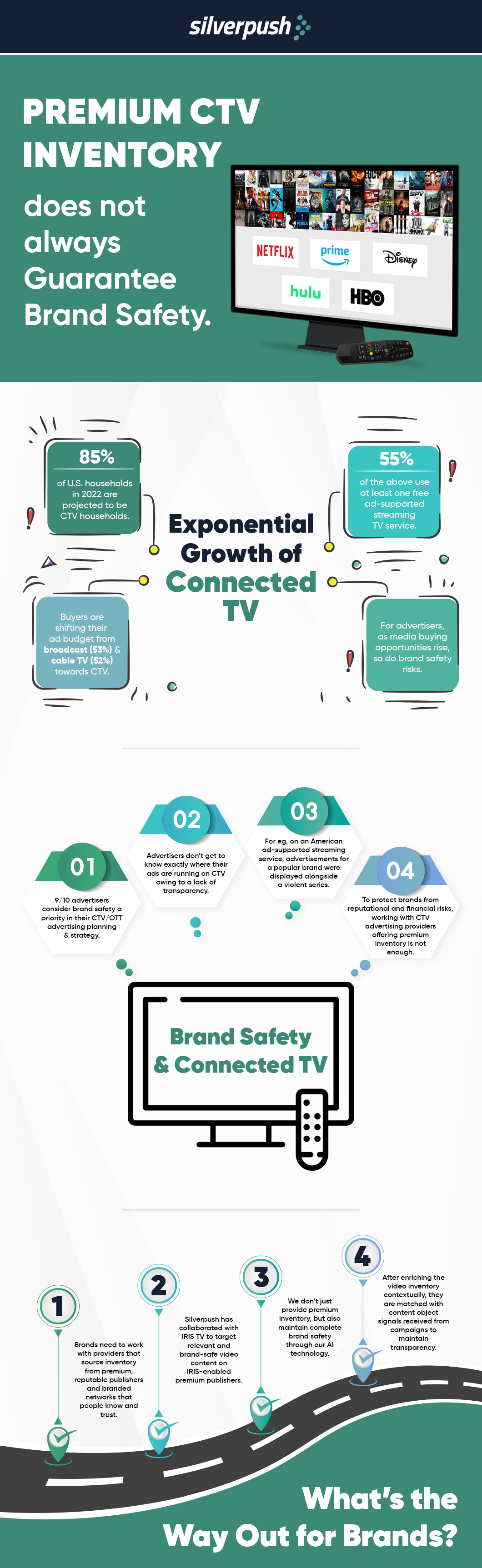

This is the primary reason why buyers are planning significant increases in their CTV ad budget in 2024. According to IAB, ”Buyers are reallocating ad spend on CTV from broadcast (53%) and cable TV (52%) advertising.

CTV and OTT devices are quickly gaining momentum and will soon be among the main video advertising platforms. If you’ve realized how significant CTV will be in 2024, this blog is for you! Dive deep into this article to grasp the essence of CTV, how it works, and what’s in store for 2024.

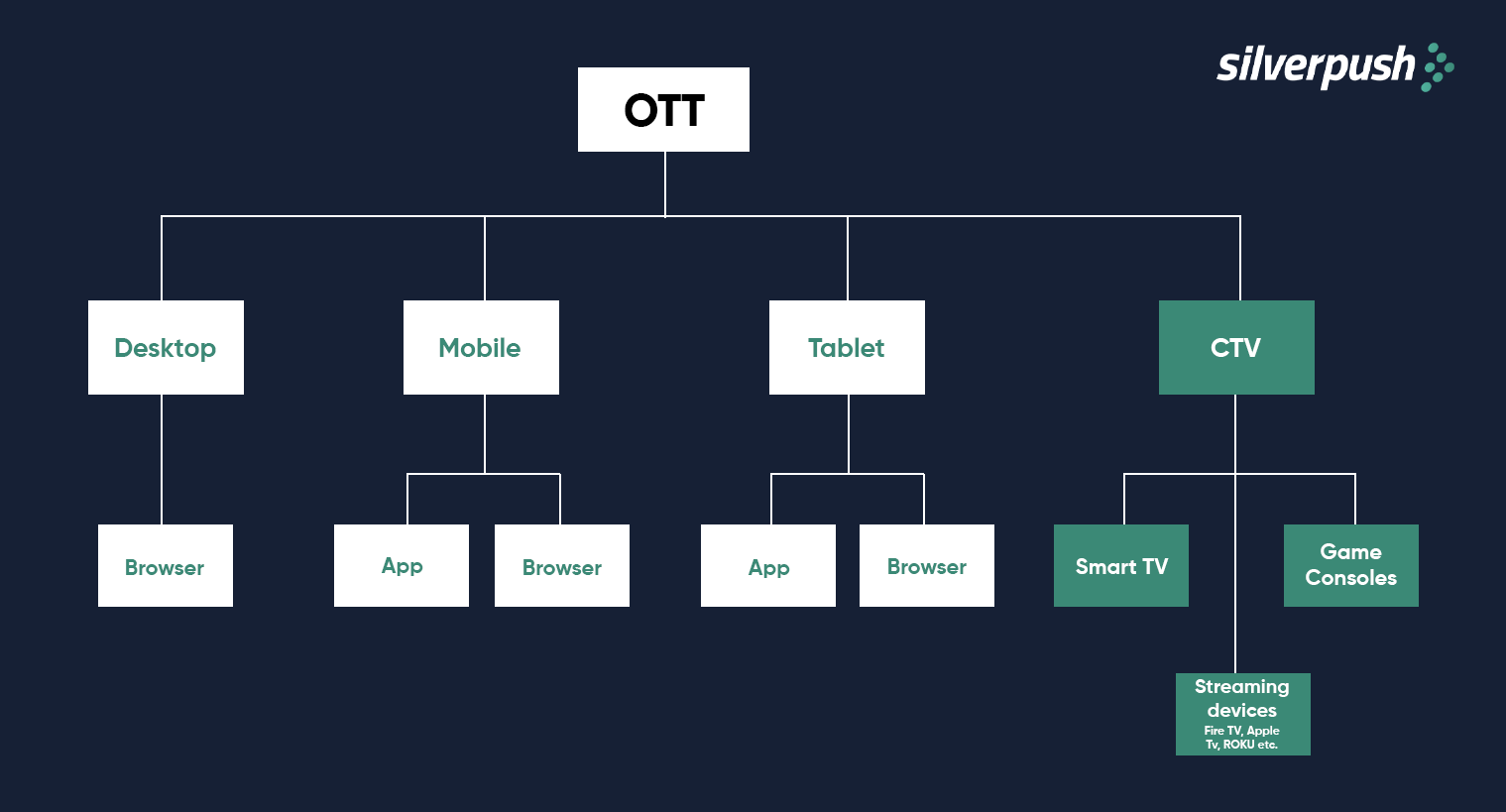

What is Connected TV (CTV)?

Before moving forward, it is important to understand what CTV means in advertising. A connected TV is a device that is used to stream video content over the internet. There are different types of CTVs including:

1. Smart TVs

A Smart TV is an internet-connected television set that contains free and paid services such as YouTube, Netflix, Hulu, and others, eliminating the need for an add-on streaming device.

2. Connected Devices

These are over-the-top, or OTT, devices that plug directly into a television set, connect to the internet, and feature both free and paid streaming programs such as YouTube, Hulu, and others.

3. Gaming Consoles

Streaming apps on gaming consoles such as Xbox, Playstation, and Nintendo may be used to broadcast video content to television sets.

What is CTV Advertising?

CTV advertising or Connected TV advertising, allows brands to reach their audience on CTV and OTT devices. The advertising takes place via downloaded applications that stream video content such as television shows. Brands can target their audience on CTV by displaying ads on premium, ad-supported shows provided by top-tier networks with complete brand safety for CTV.

What’s the Difference Between CTV and OTT?

The Video Advertising Bureau (VAB) defines OTT as “premium long-form video content that is streamed over the internet through an app or device onto a TV (or PC, tablet, or smartphone) without requiring users to subscribe to a wired cable, telco, or satellite TV service.” Connected devices are defined by VAB as “internet-streaming players, game consoles, and connected TVs.”

Why is CTV Advertising Taking Center Stage in 2024?

Sooner than expected, connected TV advertising has become the most demanded platform by brands to reach their target audience. Below are some of the statistics on CTV which prove why.

Top CTV Advertising statistics

1. 98% of brands believe connected TV advertising will be bigger than mobile in the next two to three years. (MarTech)

2. CTV ad impressions account for half of all video ad impressions, (nearly double that of mobile). (Invoid and Digiday)

3. CTV is now mainstream—over one-third of American households have shifted to streaming as their exclusive source of television entertainment. (National Library of Medicine)

4. As of 2022, 87% of US TV households have at least one Internet-connected TV device. (Leichtman Research Group)

5. In 2022, there will be 60.5 million monthly connected TV users among Millennials, and it’s estimated this number will hit 62.6 million by 2025 (+2.1 million growth). (Statista)

6. Connected TV ad spending increased by 57% in 2021 and reached 15.2 billion US dollars. It’s estimated to grow by 39% and hit 21.2 billion US dollars in 2022. (IAB)

7. 63% of respondents say CTV ads can allow more precise audience targeting. (Invoid and Digiday)

What’s Stopping US Marketers from Investing in CTV Ads?

Along with the looming brand safety risks for CTV advertising, there are several other factors that are forcing brands to step back from advertising on CTV and OTT devices.

As per a report by eMarketer, there are several factors that influence the ad spending of US Advertisers, the main ones are:

- 47% of marketers worldwide would spend more on CTV advertising if they had access to higher-quality targeting data.

- 36% are looking for a more efficient buying or planning process.

Brand Safety Issues in CTV

In spite of having so many advantages, just like other channels, even Connected TV advertising is not spared from brand safety risks. There is a high risk of running ads alongside objectionable content on CTV The same variety of apps and content that other platforms have also existed on CTV. Many aren’t aware, but there are adult apps, screensaver apps, etc. on CTV. In short, CTV is not just premium television.

Does displaying ads on Premium CTV inventory solve the brand safety issue?

How will Contextually Targeting on CTV and OTT Platforms Help?

It is important to understand viewers and their preferences in all types of media. However, engaging with them through relevant ads is much more important.

If you don’t reach that viewer in a contextually relevant environment, then all you have left in the end is a wasted opportunity.

Users are more likely to see and respond to ads that are relevant to the context in which they are seen.

If the content and offers in the TV ad are relevant to what the individual is seeing, there is a greater possibility the person can be converted into a consumer.

On the other hand, if ads aren’t appropriate to the context they are viewing, people may find them unpleasant, obtrusive, and irrelevant, negatively impacting their connection with the brand and product offering.

Needless to say, advertisers aiming to boost the long-term impact of their TV ad content and the loyalty it may engender from consumers would benefit greatly from this alignment between context and digital advertising.

Context is everything, all the time. It is important in Connected TV ads as well!

Disney+ Now has Ads, Here’s What Brands Need to Know

PUBLISH DATE: 09 December 2022

Disney+ has launched its much-awaited ad-supported tier today (December 8) just a month after Netflix launched Basic with Ads, and to no surprise at a cheaper rate – $6.99 a month. Without a doubt, streamers are truly embracing ads.

Disney is one of the last major streamers to roll out its ad-funded plan, but the company is no rookie in this space. Disney’s years of experience selling ads on Hulu gives it the edge in terms of expertise and longstanding client relationships which makes it stand out from the pack in what is an increasingly crowded marketplace of streaming services.

Furthermore, Disney+ is the only US streamer that built its own ad server.

It is believed that Disney is asking $50 CPM and a $2m commitment just below the $65 CPM Netflix is charging.

After announcing its streaming inventory would be up for grabs, Disney walked away from 2022 Upfronts with a record-breaking $9bn in advertisers. It was a much-anticipated property.

As far as the users are concerned, the ad load will be low with an average of four minutes per hour below in comparison to its competitor broadcast channels which would typically carry up to six minutes per hour and in line with Netflix. When compared to NCBU-owned Peacock, which runs five minutes of ads for every hour, that’s fewer ads. Moreover, Disney-owned Hulu runs between 09 to 12 ads in an hour.

It’s also brought to notice that Disney will block ads on children’s profiles and will ban ads related to alcohol or politics.

The company’s sales house, Disney Advertising has been tasked with selling inventory to its streamer. Across its network, the sales house offers over 1,800 audience segments built from 100,000 attributes. On the measurement front, Disney offers tracking brand lift, and attribution based on KPIs, social, valuation, and audience verification. It also runs a self-serve platform and has a programmatic marketplace.

Rita Ferro, Disney’s global president of advertising, told today’s Future of TV Advertising Global conference in London that over 100 advertisers and all the major holding companies have bought ads on Disney+ as the streaming service.

At the conference, she also revealed some key information about the work Disney has undertaken to build an advertising sales team, and how it will use first-party data in addition to advertiser data to offer targeted solutions.

Chief executive officer and co-founder of IRIS.TV, Field Garthwaite, says Disney needs to focus on improving ad relevance and brand suitability to meet advertisers’ expectations.

He further said that incorporating video-level content data into its advertising solution can help Disney to increase the value of its new add-supported options while minimizing the risk of bad viewing experience and brand sentiment by avoiding ad placement in unsuitable environments.

Though Disney+ has launched a cheaper tier in the US with advertising, it has still not been confirmed precisely when this will roll out to other markets.

Could the UK be next on their roadmap?

Why Political Advertisers Need a CTV Strategy Ahead of the 2024 Election Cycle

PUBLISH DATE: 22 November 2022

Voters are soon going to line-up to the polls for the 2022 midterm elections, and marketers have this huge opportunity for ramping up their political advertising campaigns. Kantar predicts that Political ad spending for 2022 midterms will reach $7.8 billion. Though, it is no question that broadcast TV will lead the pack, but advertising across digital channels will continue to show significant growth.

This year is the growth in connected TV (CTV) advertising, which is expected to reach $1.2 billion.

Many political marketers began experimenting with CTV ahead of the 2020 elections, but due to pandemic, there has been behavior shift, due to which streaming viewership has grown faster than anyone expected since then.

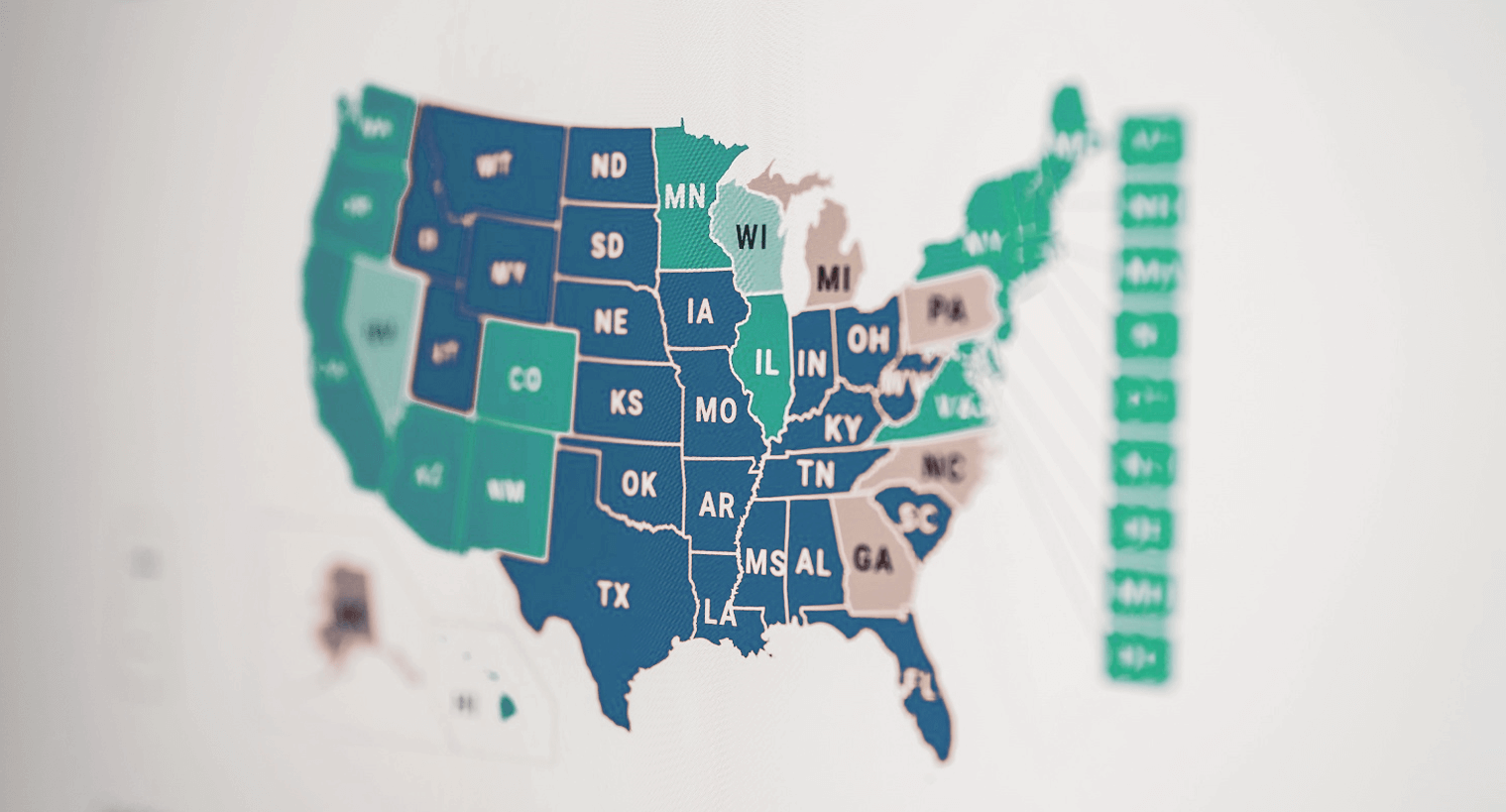

As of now, there are 85.7 million streaming households in the US, creating a prime opportunity for political marketers to engage voters in every corner of the country.

It’s just a matter of time until the 2024 election campaign will begin to heat up, media strategies for national races are starting to take shape. Political marketers need to build a well-researched strategy and leverage the advantage of CTV and programmatic advertising.

CTV is a crucial part of Political ad campaign

As CTV viewership has increased, it gives political advertisers the advantage of reaching viewers on the streaming platforms where they prefer to consumer their news. The increased reach combined with highly engaging, lean-back CTV viewing experience has been able to draw more attention – and ad spend from marketers.

Optimize engagement in real-time

If marketers want to stay one step ahead of the rapidly shifting narratives of opponents, then media is crucial. CTV and programmatic enable a swift turnaround to deploy new campaign messages into the market, measure impact and optimize engagement in real time.

The superior and precise targeting capabilities of CTV allow political marketers to reach specific segment of voters on the basis of geography, household demographics, and behavior. Though the fragment CTV landscape is a real challenge, however, marketers can reach their targeted audiences in individual market without giving up or sacrificing scale.

In addition to this, leveraging programmatic for political advertising enables marketers to supply across a wider array of media owners and distribution points. They can easily deliver message to the right audience in an effective and scalable way.

Combine complementary datasets with your ad campaigns

The first-party data that is gathered through donations, surveys, or through other meaningful interactions with voters can become a powerful resource when combined with third-party data. By emerging multiple data panels, political marketers can do precise granular targeting on CTV and programmatic. Data specific to geography and device can help advertisers to identify the news inventory that is available within a voting district, whereas, other key attributes like age, gender, social engagement can help advertisers to create a personalized creative to voter’s interests. Such layered data strategy is vital to determine where, when and how to reach voters, and discovering what kind of messages can motivate them.

The advertising capabilities of CTV and its viewership have grown immensely since the last election cycle, providing an unmissable opportunity to reach prospective voters. With key midterm races happening across America, now is the time to test, learn, and prepare for the 2024 presidential election.

“CTV is Europe’s leading video platform for ad attention”, According to New ShowHeroes Group Research

PUBLISH DATE: 22 July 2022

According to a breakthrough new study, an astounding 80% of European consumers choose CTV, with connected TV generating much more ad attention and interaction than YouTube and linear TV.

The study was conducted by ShowHeroes Group, a major global provider of video solutions for advertisers and publishers. It employed cutting-edge ‘Tobii eye tracking eyewear’ and ‘eSense electrodermal response sensors’ to measure TV viewers’ attention, even on CTV (smart TVs and streaming devices).

You may also like to read: CTV Ad Fraud and How Industry can Tighten Its Standards

These biometric data were then paired with a quantitative survey of 2,100 respondents in seven important European regions, yielding conclusions with far-reaching consequences for the digital advertising business.

With attention emerging as a critical indicator in a post-behavioral world, data revealed that CTV easily won the advertising industry’s gold standard of peak attention and engagement.

Some of the study’s major findings are as follows:

- CTV has an 82% attention rate, compared to 69% for linear TV and 42% for social video.

- Users spent an average of 12.2 seconds watching CTV advertising before turning away, which is over 3 seconds longer than linear TV and 5 times longer than YouTube.

- Viewers were found to be in the “engagement zone” 71% of the time during CTV commercial breaks, according to electrodermal responses: 11% higher than in social video advertising.

CTV is used by 62% of users for the freedom it gives, with “variety of programming” and “easy of usage” rating as additional top reasons for cutting the cord with linear. Users perceived CTV commercials to be shorter, more relevant, and of higher quality than linear TV ads.

43% of people looked for a product after viewing a CTV advertisement. One-third have visited an advertiser’s website, and one-fifth have actively purchased a product after viewing a CTV advertisement.

A important result for the contextual tech industry is that 67% of consumers would prefer to see CTV advertising that are relevant to the content they are watching.

CTV Ad Fraud and How Industry can Tighten its Standards

PUBLISH DATE: 20 July 2022

Advertisers have been turning to streaming services as more and more people have abandoned their traditional pay-TV packages. Particularly, streaming platforms have been important to brands who are looking out to reach their younger audiences. Connected TV may be the media’s favorite branding tool but it’s not as clean as it may seem. And it is certainly not immune to ad fraud.

CTV ad spend in the United States have increased by over 100 percent between 2019-2021. Globally too, CTV investments are on the rise. However, due to limited TV inventory and supply is harder to break into than mobile and desktop – it becomes easier for fraudsters to slip malicious mobile apps onto phones than they can get CTV apps into Roku accounts.

Media buyers generally assume that CTV is a relatively fraud-free environment. It’s hardly surprising to witness that CTV ads are a popular target for fraudsters. CTVs have one of the highest CPM rates in the digital advertising space, ranging from $35 to $65 per thousand impressions. These rates are high as such ads not provide additional value to brands but also attract new customers, which in turn increase engagement.

Recommended for you: Adtech Setting a Benchmark for Future Generation

Because of the absence of robust tracking and measuring functions, it is easy to commit ad fraud on connected television channels. According to projected estimates, connected TV fraud would cost publishers $144 million in 2022. Thus, the responsibility to prevent fraud falls on the shoulders of brands and media buyers. The industry’s best shot at fighting such fraud is to increase transparency as much as possible across the bid stream.

Adopting a wider adoption of Sellers.json can make open programmatic a safer environment. Similar to Ads.txt, Sellers.json is intended to help detect fraud, however it works on behalf of the buy side. It works by delineating the programmatic and direct supply-side partners in a campaign.

How the Death of Third Party Cookie Matters to CTV Advertising?

PUBLISH DATE: 22 June 2021

The evolution of media consumption worldwide turned a page when Connected TVs arrived on the scene. Though the technology had been lingering in the back alleys since early 2000, it only found serious takers in the last decade or so. The global pandemic coupled with the rise of OTT platforms nudged CTV’s popularity in the right direction. So much so that over 70 million American households now own a CTV streaming device on which they end up watching up to 10 hours of content daily.

Coupling this trend with the imminent death of third-party cookie tracking on browsers has given rise to a fresh marketing approach that has got advertisers excited. CTV advertising offers an opportunity to serve ads to an audience that is growing by the day, and the ability to do it in a brand safe environment that puts data privacy at the heart of its operations.

Is CTV advertising the silver lining to the cookie catastrophe? Let’s find out

Benefits of Linear TV, but only Better

Brands are increasingly showing interest in CTV advertising because of the many benefits it provides. However, the one advantage that stands out is its ability to boost incremental reach. This metric has become the gold standard for CTV advertisers as ‘cord cutting’ or moving beyond linear TV to streaming platforms is becoming the norm worldwide.

With the surge in consumption of connected TV content, marketers can now leverage CTV advertising in conjunction with their linear TV campaigns and achieve improved incremental lift across audiences that might have been left out on the conventional TV medium. CTV in its origin is subscription based, meaning operators have exclusive access to first-party data like emails, IP addresses, and the like, which can be used to identify segments that can further bolster the targeting efforts.

Optimum Brand Safety

One niggling issue that all brands faced with third-party data was that of brand safety. Having your ads run against the backdrop of content that includes terrorism, gun culture, substance abuse, etc. is never a good thing. CTV advertising offers a respite for marketers in this aspect.

Connected TV as a platform makes use of first-party data points like device IDs and advertising IDs to ensure privacy laws are upheld and consumers get to choose the kind of ads they view. This gives marketers the ability to customize the video ad experience to add a layer of relevancy to ad delivery. While CTV has the ability to deliver relevant ads without using cookies, it also ensures high quality impressions. This is made possible by the private marketplace (PMP) model that allows bidding only by invitation thus attracting verified buyers.

Video Context is the New King

In its essence contextual ad targeting has been around for a long time. With text-based triggers marketers could serve ads that resonated with their target audience. But a step forward in this direction is video contextual targeting.

With the help of nuanced technologies like AI and machine learning, video and image based visual triggers can be identified to create even more relevant targeting opportunities that drive results. This technology also liberates advertisers from the grips of third-party data, since it analyses the content feed directly rather than URLs.

All the trends indicate that CTV advertising is slowly gaining momentum and it will only get stronger now that third-party cookies are out of the picture. Together with advanced contextual marketing is making its presence felt in filling the gap.